The information and material on the site, the material sent to users is for educational purposes only and should not be considered as advice, recommendations or solicitation to the public to save. Trading in futures and options involves significant risks and is not suitable for all savers and investors. The capital lost may be greater than that paid into your bank. Past performance is not necessarily indicative of future results.

Get our strategy

Follow money, manage your risk

ag@privatetrader.it

Take control of your savings

Manage independently and grow your financial assets

Learn our methodology applied to trading on the S&P500 stock index. We will teach you methods used by institutions to achieve a target of at least 1% per month and efficient risk management

Within 3/5 months you will be able to obtain a steady profit from your savings

Join the live trading sessions and discover the trading strategies we use in the S&P500 stock market. Sign up for our professional training course on derivative instruments

We offer a training course lasting between 3 and 5 months on derivative instruments of the US stock market: analysis techniques, risk management, and practical application in options and futures trading. By managing highly dangerous financial instruments, comparable to nuclear power, it is possible to control the risk they entail and obtain a suitable annual return.

The program allows access to our daily trading journal, updated in real time with the orders we place in the market and the related reasons. It includes theoretical modules with detailed explanations of each operation and allows you to develop autonomy in managing your own portfolio, through the study and interpretation of the main market indicators that we provide.

Our methodology guarantees results: if the monthly profit is less than 1%, you do not pay for that month of the training course. The amount paid will be used as a fee for the following month, and the same applies for the second month; if, after three months, we have not achieved at least a total of 3% profit, we will refund your entire fee (the 3 months you paid for). This protection is designed to ensure maximum commitment and confidence in the training process.

Why we offer you our knowledge

The goal of our trading course is to teach you how to operate with confidence and awareness in the options, futures, and derivatives market on the S&P 500, maximizing profits and managing risks. The integrated use of options and futures, unlike only using the underlying (stocks, ETFs, futures), allows you to optimize profits even in sideways or low-volatility markets, if managed correctly. The trading course in derivative instruments on the US stock market enables you to achieve prudent risk management in trading activities, which is our main purpose... careful risk management.

The foundations of our methodology

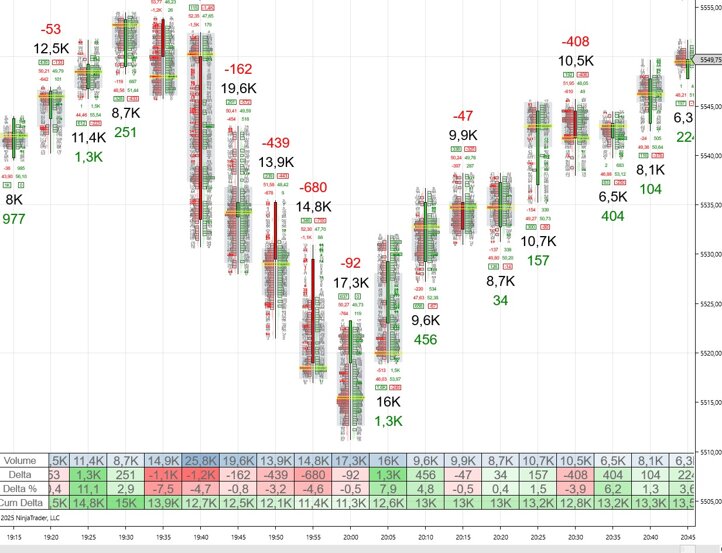

The foundations of our trading methodology are 'Follow Money' and 'Risk Management.' By following the capital flow of institutional operators, market makers, and large traders, we analyze market signals such as bid-ask spread, implied volatility, and sentiment indicators to predict market trends and manage risk. Risk management is central: we use hedging strategies and well-defined loss limits to protect capital in situations of high volatility or panic selling.

What we offer you

Our training will provide you with the skills needed to face even the "storms" of the stock markets, characterized by increased volatility, higher margin requirements, wider spreads, and margin calls. Through our methodologies, you will be able to interpret signals of fear and market capitulation, identify the most opportune moments to enter the market, manage risk and trades with discipline, aiming to achieve a stable and sustainable monthly return.

What we ask of you

Getting results requires commitment, read the following text carefully.